🌊What is Trailing stop-loss?

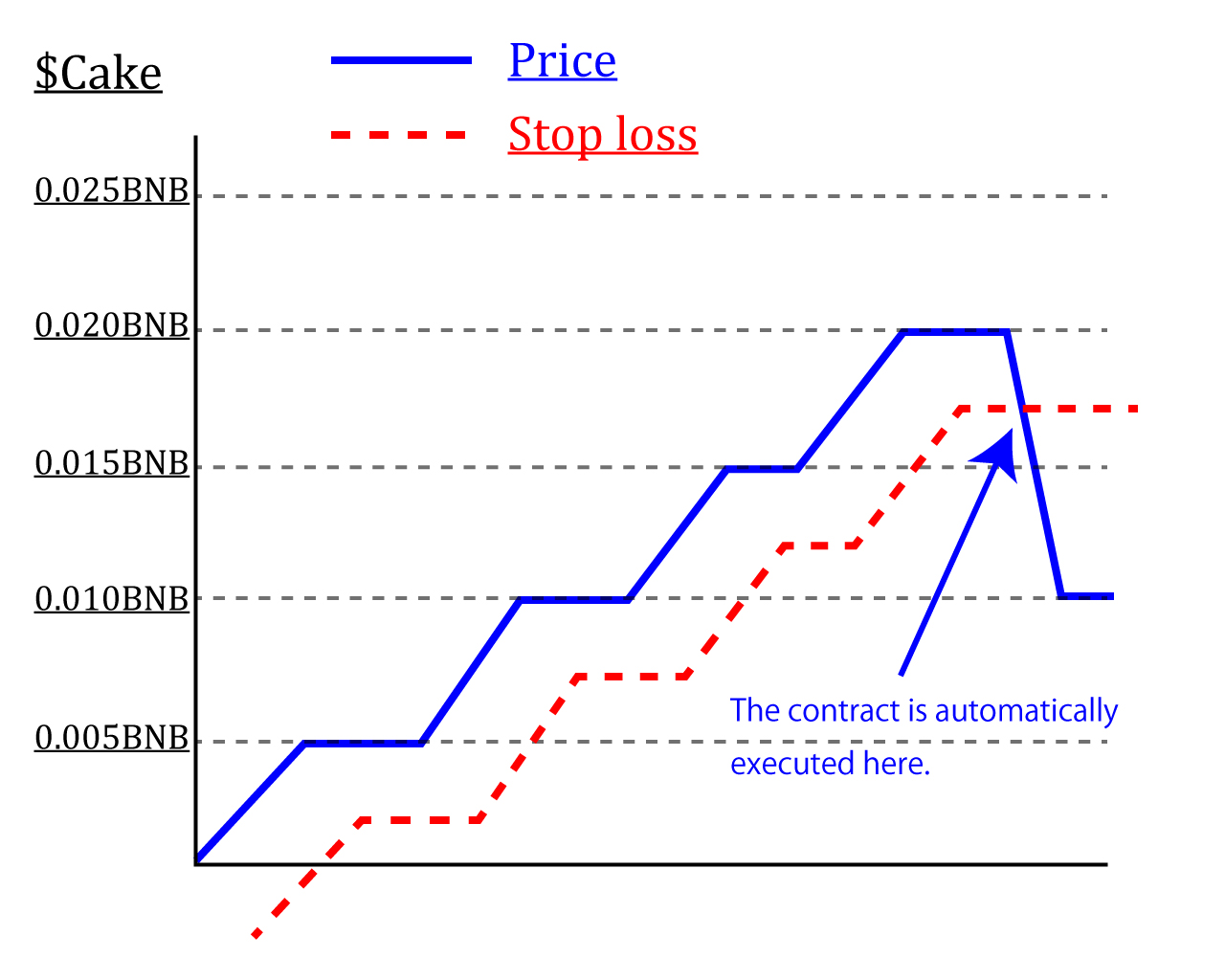

A trailing stop is an order method whereby if the price moves in a favourable direction, the stop order will also slide by a certain width. As the price rises, the stop order also rises, allowing more profit to be made in the event of an unexpected fall in price.

Why is this better than a normal stop-loss?

For this example, we’ll look at three traders, A, B and C. All three bought $Fungle at $100 However,

Trader A reckons nothing can ever go wrong and just leaves his trade open.

Trader B is a bit smarter and knows that Shitcoin trading can be quite volatile, so he sets a standard stop-loss to trigger if the price drops to 75% of his entry price.

Trader C also sets his stop-loss at 75% of his entry price, however he’s even smarter and knows that Fungle Trailing Stop-Losses is the best tool available for giving peace of mind when making these kinds of trades. He sets a Trailing Stop-Loss to trail 75% of the ATH price of the token.

Later that night, $Fungle pumps 200%, but then quickly dumps to 50% below our three trader’s entry price. All three traders are asleep and miss the price action.

Trader A wakes up and panic sells, losing 50% of his investment.😭

Trader B wakes up and has only lost 25%, thanks to his 'normal' stoploss. 😔

Trader C wakes up to a tasty 175% profit.😎😎😎

Why? As the price increased, Fungle's Trailing Stop-Loss followed it, constantly setting the exit price to 25% below the current price. ↓Fungle,Multi Trading Platform for Crypt↓ 🌍 Web : https://www.fungle.io/ ✈️ Telegram : https://t.me/Fungle_io 🎮 Discord : https://discord.gg/NuMC99HSd8 🐤 Twitter : https://twitter.com/Fungle_io

Last updated